We all know that socially responsible investing means investing in good companies, but how do we determine which companies are in fact good?

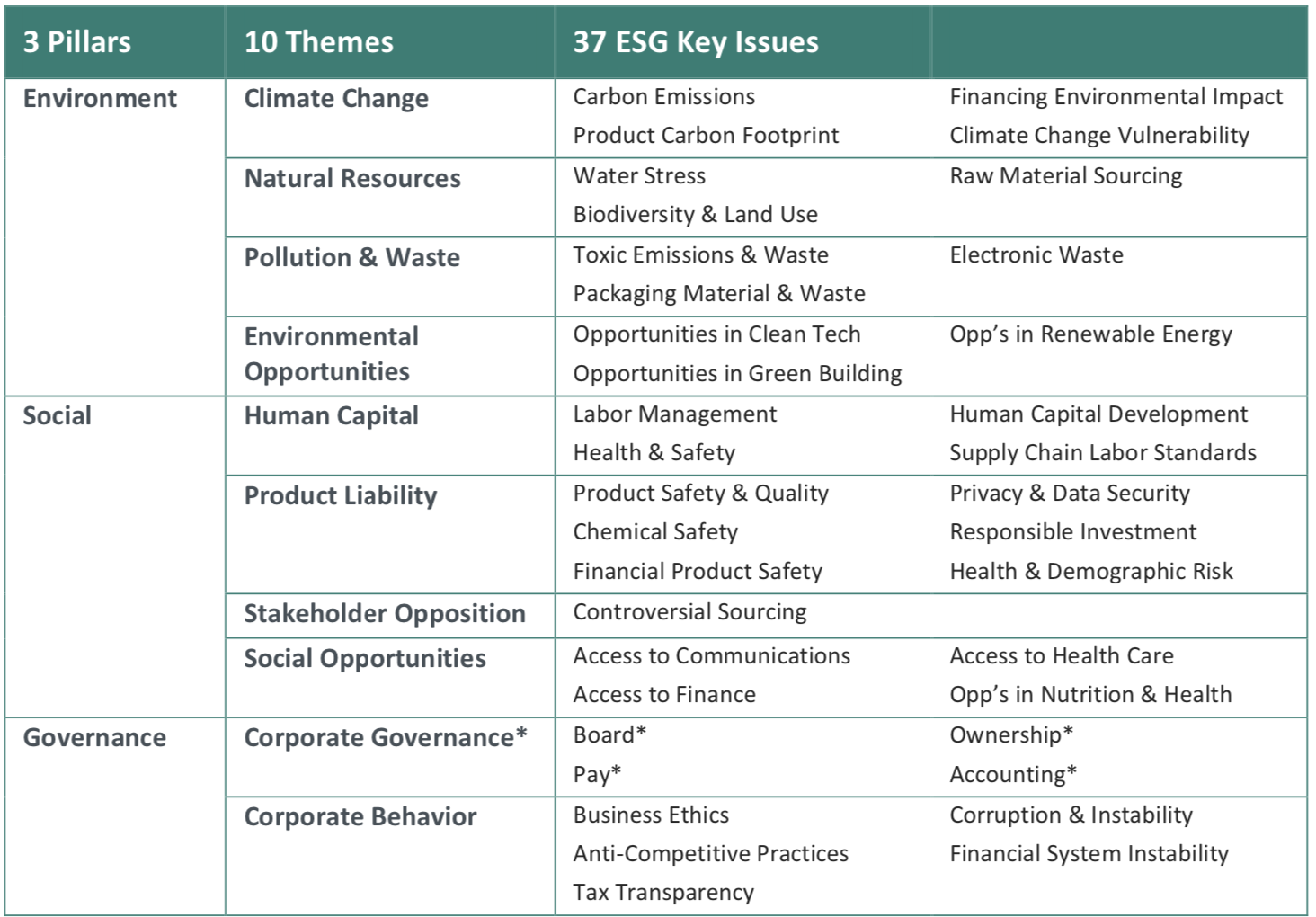

To restate from a previous post on what is SRI, socially responsible investing considers environmental, social and corporate governance (ESG) criteria. Essentially, if you’re investing responsibly, you’re investing in companies that are held to a higher standard in terms of environmental, social, and corporate governance standards. Here are some examples of themes and issues that may be included in each ESG category.

Let’s take Costco for example. Costco is a company with high ESG ratings. I already love Costco with their endless lunchtime samples and hot dog soda combo for $1.50. Unreal. On top of having delightful edible options, Costco has also introduced new environmental initiatives such as compostable coffee pods in its warehouses, a new policy regarding the use of chemicals, and a commitment to install solar panels at its stores. Costco is also known for treating their employees well, offering a minimum wage of $15/hr as well as awesome benefits. Who else loves Costco even more now?

Companies like Costco that measure strongly along ESG factors may be better positioned for growth in the long-run and are less likely to be plagued by controversial scandals. Together we can make a difference by investing in companies that align with our values and divesting from others. That’s what we’re doing here at Good Capital.

Stay tuned to learn how you can invest responsibly. You can find our other posts on socially responsible investing and leading a financially healthy life here.

In case you wanted to learn more about Costco’s $1 hot dog, you’re welcome.