1 PERFORMANCE

As an investment advisor, we are a fiduciary which means we have a legal obligation to act in your best interest. First and foremost, our responsibility is to help you reach your financial goals and strive for strong financial returns.

Good Capital Investment Group approaches investing through a sustainable, responsible, and impact investing (SRI) lens. This means that in addition to traditional fundamental and quantitative investment research, we consider environmental, social, and governance (ESG) factors as well as your personal values when developing your financial plan and selecting funds for your investment portfolio. Investing responsibly doesn’t mean you have to sacrifice performance. We fundamentally believe that positive financial returns can and should be coupled with social progress.

2 ENGAGEMENT

We genuinely enjoy working with our clients and are only a phone call or email away. We're delighted to answer any and all questions you have throughout your financial journey and will be there for you as your financial confidant. Think of us as a close friend, here for you when you need us, acting with your best interests at heart.

3 IMPACT

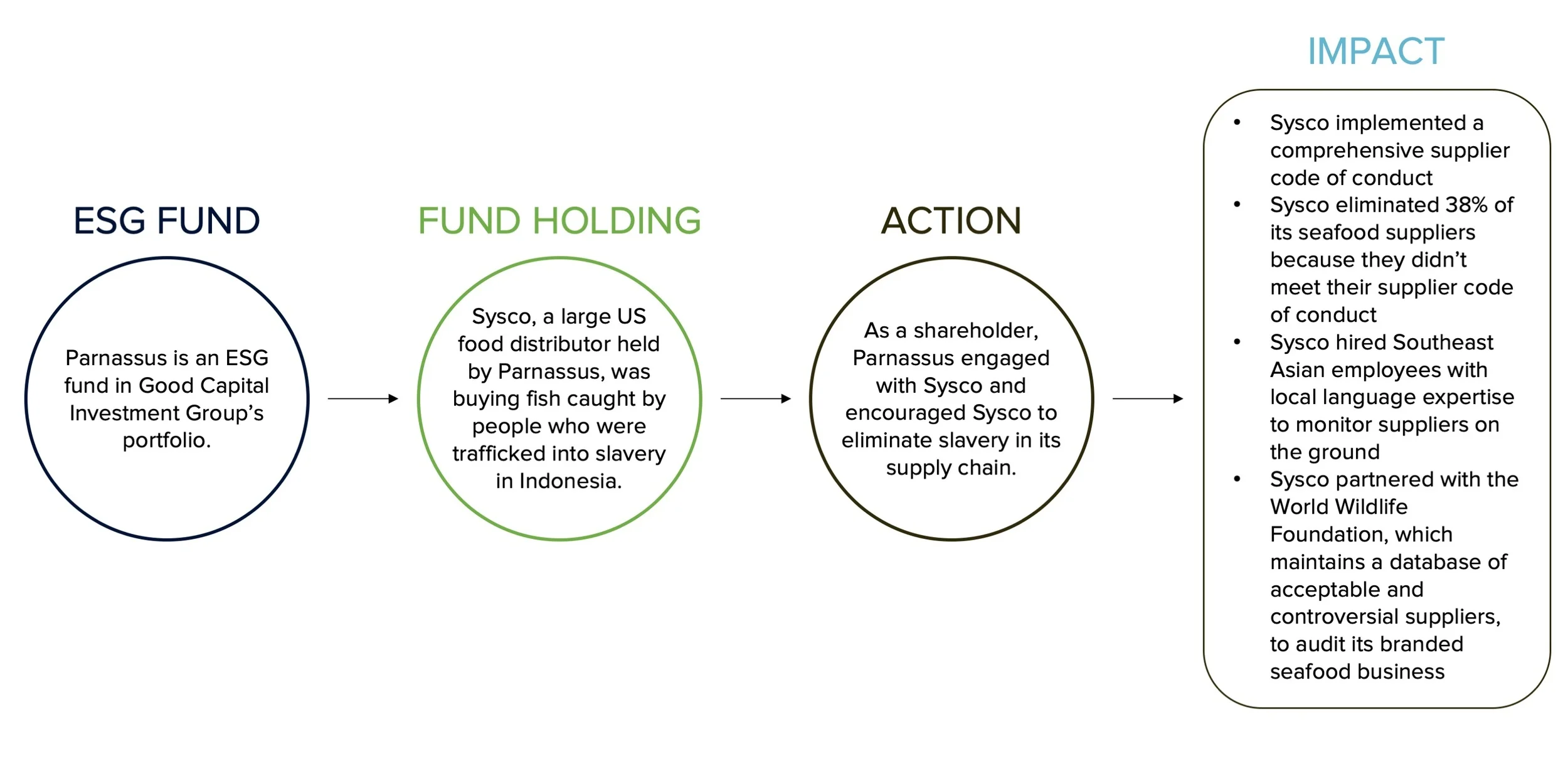

Good Capital Investment Group’s investment portfolio includes mutual funds, equities, real estate investments, and fixed income positions that continually exemplify responsible and socially conscious values. Many of the ESG funds we invest in directly engage with companies in their portfolios to influence positive social and environmental change.

Next up, what makes a company “good.” Check out our other posts here.